Let's Build Your Business Credit & Find You Funding

Get access to the industry leading software and coaching to guide you into the funding you deserve

Common Questions

Frequently Asked Questions

Discover the world of business loans with our FAQs, covering key topics to help you make informed decisions and unlock growth opportunities.

What Do I Get With Your Services?

✅When you choose our services, you get a comprehensive package of benefits.

✅First, you have round-the-clock access to our Business Funding Suite, empowering you to manage your funding needs at any time.

✅We assist you in establishing a strong foundation of credibility for your business, which is crucial for attracting funding opportunities.

✅Our Funding Match service ensures that you discover the right funding options tailored to your specific needs.

✅Moreover, we guide you in building your business credit, opening doors to numerous credit lines for your business.

✅Additionally, you receive personalized coaching for 12 months, providing you with expert guidance throughout the process.

✅To further enhance your experience, you enjoy full access to our services for a duration of 5 years.

✅Finally, we offer a comprehensive funding strategy session, enabling you to plan your financial journey effectively.

Does Your Service Work?

Yes! Funding your business requires a strategic approach. We take a holistic view of your financing needs and tailor our services to match the growth of your business. While it's not an instant fix, our long-term solution will help you secure the funding you need to fuel your business's growth.

Can You Guarantee I Will Find My Funding?

Unfortunately there are no guarantees. Business loans depend on various factors tied to your success. If you currently don't qualify for funding, we will work with you to explore alternative solutions while we help make your business fundable.

1️⃣Create your Foundation of Fundability by establishing your business entity and addressing the 125 elements of your business profile from which lenders use to consider loan applications on the EIN.

2️⃣Gradually build your business credit profile through timely payments, diverse credit accounts, and monitoring your credit report.

3️⃣While an SSN may be needed for identity verification, providing a personal guarantee can expand financing options.

By following these steps, you can secure business credit without relying solely on your SSN, thus maintaining financial independence between your personal and business finances.

What If I Can't Qualify For Funding?

No worries! That's where Business Credit comes in. Business credit allows you to access high-limit credit lines using only your business's EIN. There are no income or asset requirements, and you can qualify for many accounts without a personal guarantee. Additionally, building business credit improves your chances of getting approved for better business loans. We'll help you secure financing to build your credit and work together to get your business ready for funding.

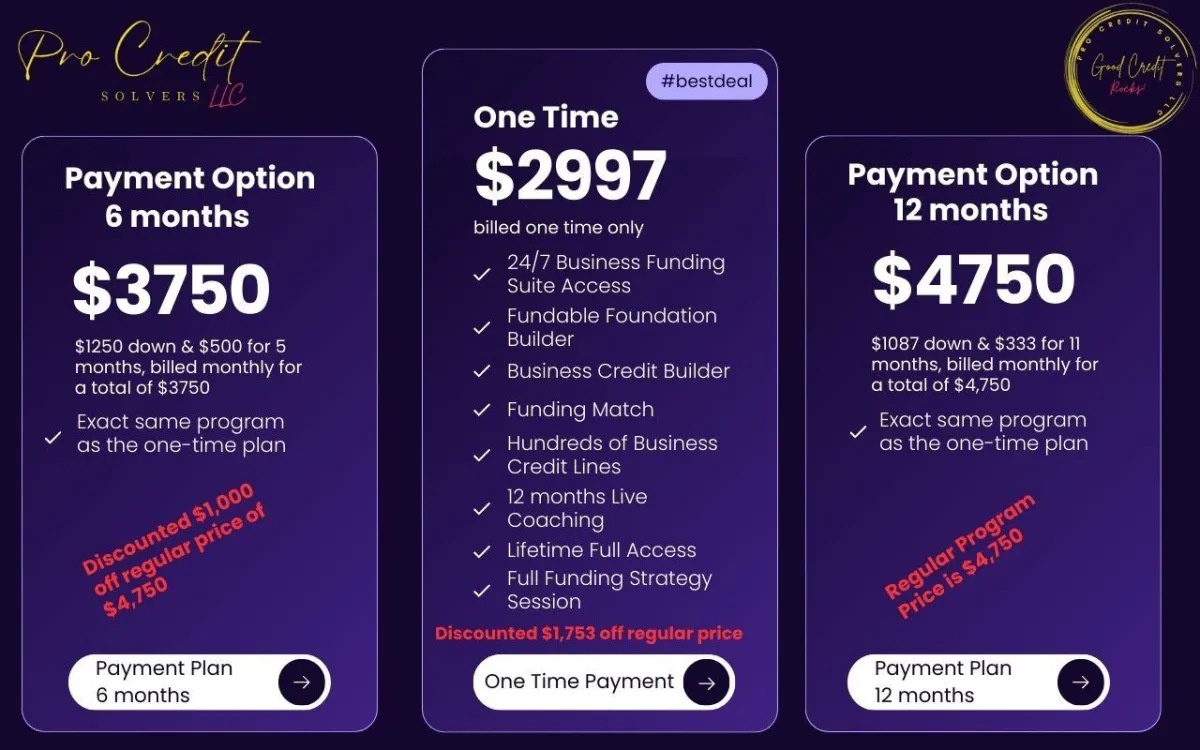

What's the difference between the programs?

The Funding Accelerator program provides you with 5 years of access to the Business Finance Suite, 12 months of live support and coaching, and a customized funding plan strategy. This plan will guide you throughout your entire funding journey.The Funding Builder is month to month access with just online support. A great option for the self motivated who just need the right tools for the job!

I Have Bad Credit, Can I Get a Business Loan?

Absolutely! There are a couple of options available for business owners with less-than-ideal- credit.

1️⃣Establish your business credit profile and build your business credit on your EIN. Lenders that loan money on the EIN don't consider personal credit. the process takes six months to two years depending on how fast the business owner works through the program and the strength of the business revenue.

2️⃣Improve your personal credit. Ask about improving personal credit.

3️⃣We have a lender that can approve loans on 500+ credit scores.

Will this work for a Startup Business?

Absolutely! Starting your funding journey as a startup can accelerate your success and provide you with the necessary funds to grow your new venture.

Have Questions? Let's Talk!

Schedule a free funding planning session to find the right fit for your situation

Office:

400 W Capital Suite 1700

Little Rock, Arkansas 72201

Call:

888-904-5220

Email:

Site:

www.goodcreditrocks.com

Copyright © 2026 | All rights reserved

Facebook

Instagram

X

LinkedIn

Youtube

TikTok